defer capital gains taxes indefinitely

If the gain is. Over one-fifth of your hard-earned income is lost immediately after completing.

Learn How To Defer Capital Gains Tax For 30 Years Aaoa

453 one will not find the words.

. This allows them to receive monthly payments for the interest accrued on their investments. You can defer capital gains taxes until 2026 if you invest in an opportunity zone. By performing a 1031 exchange investors defer capital gains tax indefinitely as long as they continue to reinvest the principal in the property.

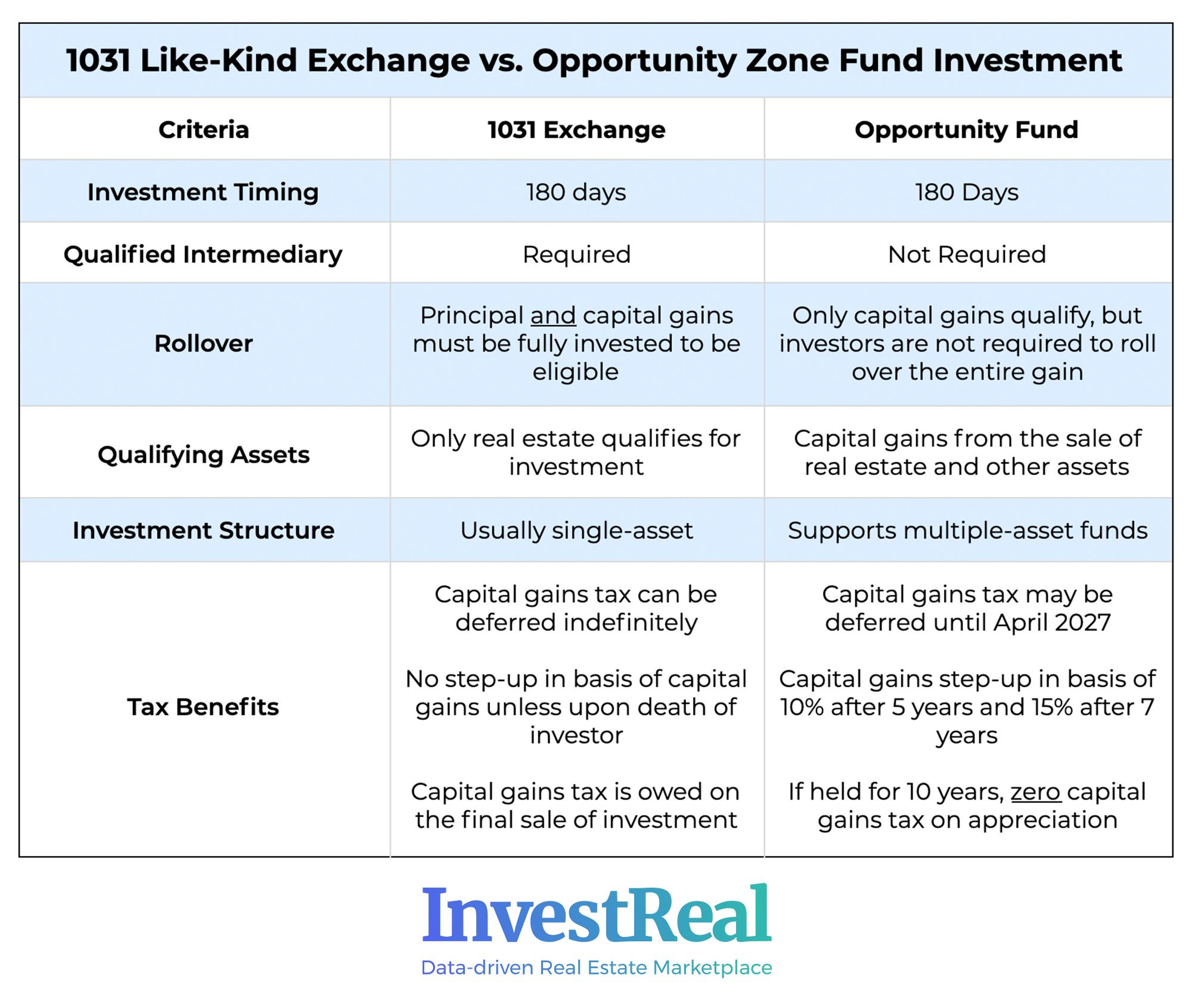

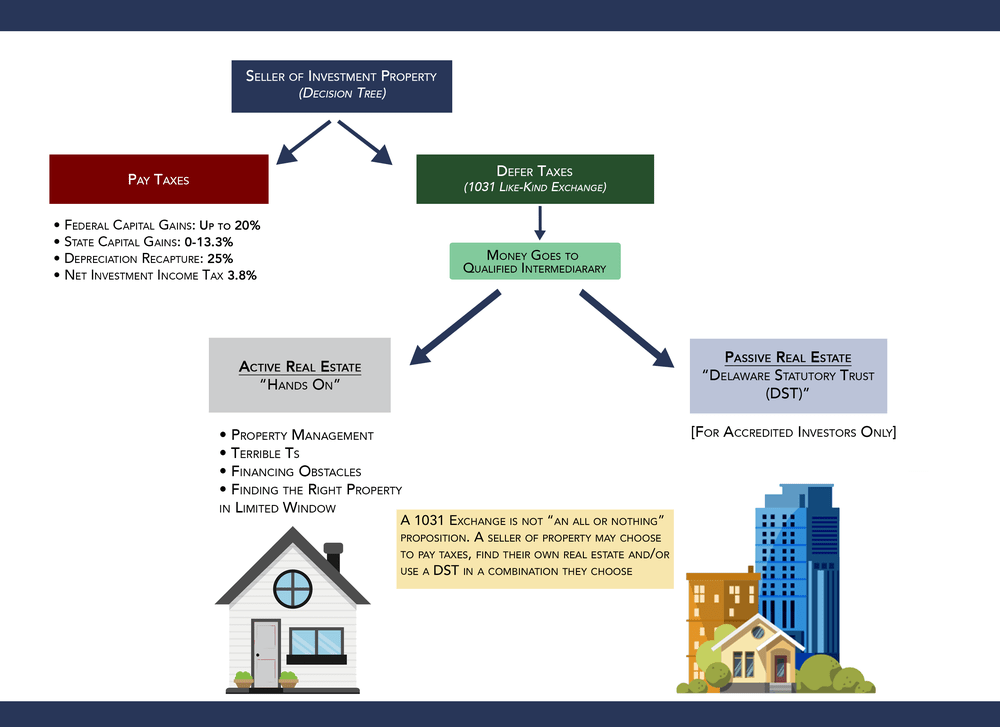

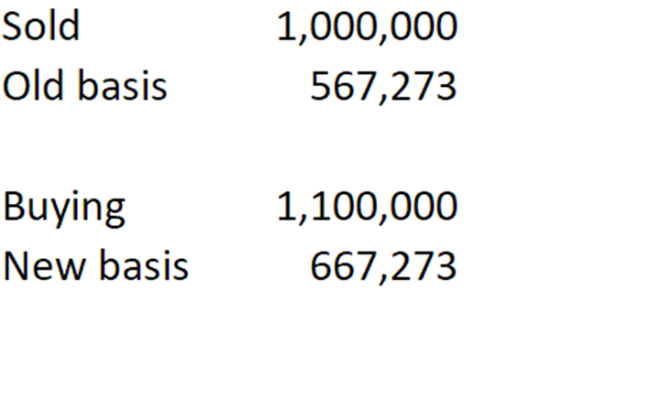

A 1031 exchange allows a seller to sell an. Capital gains taxes can seem like a significant detriment to your earnings when youre trying to optimize your profits with investments. Structuring real estate transactions as 1031 tax-deferred exchanges allows an Investor to defer 100 of their income tax liabilities.

1031 Exchange Investors can defer capital gains taxes indefinitely. Your first question might be what is a Deferred Sales Trust Good question. Opportunity Zone Investors can defer their gains until 2026 at which point the transaction.

You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be. First of all a Deferred Sales Trust. Leverage the IRS Primary Residence.

Opportunity Zones offer tax benefits to investors who elect to temporarily defer tax on capital gains if they timely invest those gain amounts in a Qualified Opportunity Fund QOF. Many clients choose to indefinitely defer their capital gains taxes by investing the entire principle. Instead of their equity going toward the payment of income.

6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. Their capital gain taxes and depreciation recapture taxes can be deferred indefinitely by continually structuring and using 1031 Tax Deferred Exchange strategies. In other words the best way to use the 1031 exchange is to always keep the equity invested by structuring 1031.

If you sold your practice for 4 million you could end up paying 800000 to 13 million in capital gains taxes. Well Id like to introduce you to a little something called the 1031 ExchangeMany savvy investors use this to multiply their returns and defer capital gains tax on the sale of their. Anyone can defer capital gains taxes indefinitely using a Deferred Sales Trust.

Normally to defer the taxable capital gains into a QOF the profit must be reinvested into a QOF within 180 days of the sale date. Always defer the income taxes. Many investors look for ways to reduce these taxes to.

If you hold the investment for 10 years or more you will be exempt from owing any capital gains. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. The short answer is.

Wait at least one year before selling a property. There is also 30 Income Tax relief on the investment. It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales proceeds into a like kind property the replacement property which is why this transaction is sometimes referred to as a like kind exchange.

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

How To Pay No Capital Gains Tax After Selling Your House

Investreal Investrealus Twitter

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

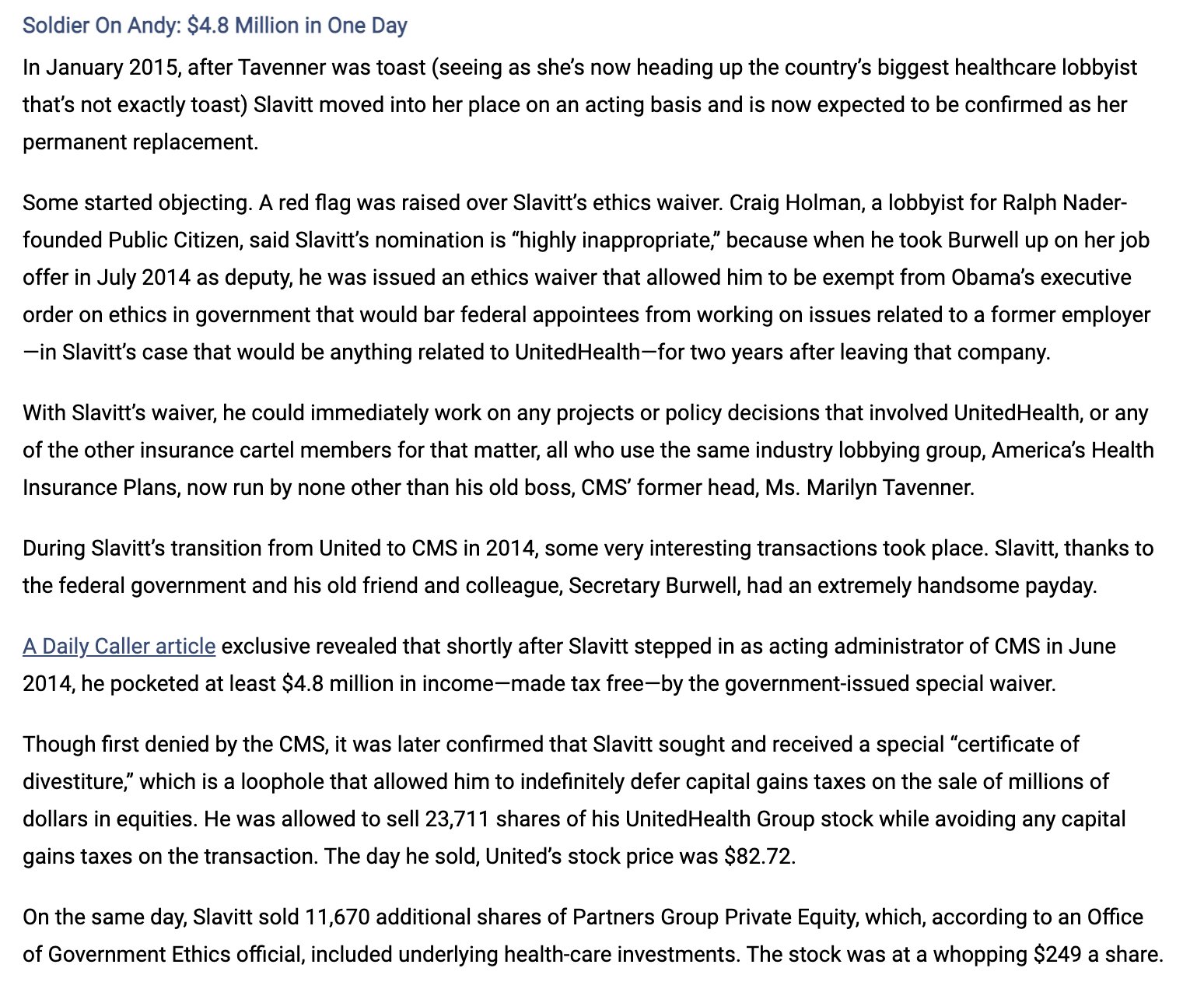

Agentninetyninemd On Twitter After The United Hc Subsidiary Where Slavitt Was Ceo Was Hit 4 Fraud Slavitt Gets Ethics Waiver 2 Join Cms So He A Gets 4 8 Million Tax Free B

Money Clip Protection Minimizing Your Exposure To Capital Gains Taxes

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Az Big Media How To Avoid Capital Gains Tax On Investment Properties Az Big Media

How The 1031 Exchange Can Turn Deferred Tax Into A Real Estate Empire

How To Pay No Capital Gains Tax After Selling Your House

Rethinking How We Score Capital Gains Tax Reform Tax Policy And The Economy Vol 36

Thoughts On Virtual Crypto Currency Taxation In The Us Htj Tax

Doing Business In The United States Federal Tax Issues Pwc

How To Defer Avoid Paying Capital Gains Tax On Stock Sales Hbla

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy