owe state taxes illinois

Tax Relief up to 96 See if You Qualify For Free. Ad Use our tax forgiveness calculator to estimate potential relief available.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

. Check or money order follow the. These Tax Relief Companies Can Help. The tax of 102 should be correct if you are Single.

Ad Use our tax forgiveness calculator to estimate potential relief available. Quickly End IRS State Tax Problems. The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability.

Illinois bases its 5 percent state income tax on your federal adjusted gross income plus or minus state-specific income adjustments. Ad Created By Former Tax Firm Owners Based on Factors They Know are Important. All residents and non-residents who receive income in the state must pay the state income tax.

Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers. It is possible to owe Illinois taxes and get a refund from your federal return in the same year. Illinois has a flat income tax of 495 which means.

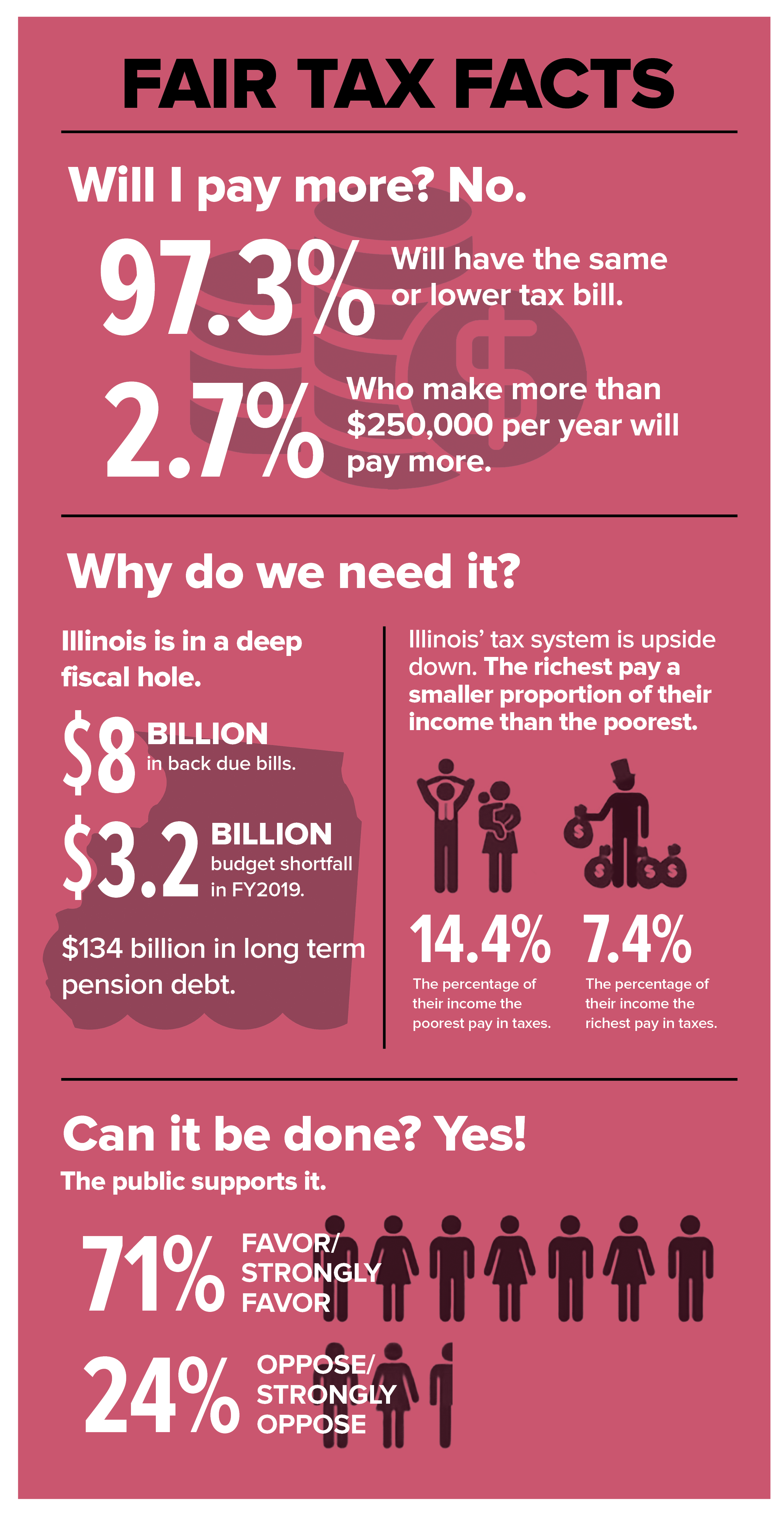

For traditional corporations the tax is 25 of net income and for other forms of business the tax. Federal and state tax laws and regulations are not the same. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

All residents and non-residents who receive income in the state must pay the state income tax. Its tax sits at 133. If you owe the state and are filing electronically you may pay the entire amount or make a partial payment instantly online at the end of your session.

These bordering states do not tax the wages of Illinois residents working in their jurisdictions. The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. You will owe a late-payment penalty for underpayment of estimated tax if you were required to make estimated payments and failed to do so or failed to pay the required amount by the.

Check or money order follow the. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Ad We Can Solve Any Tax Problem.

That makes it relatively easy to predict the income tax you. See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

We may ask the Internal Revenue Service to. Ad Owe Over 10K in Back Taxes. If you dont already have a MyTax Illinois account click here.

The Different Types of. California for instance has the highest state income tax rate in the United States. The state income tax rates are 495 and the sales tax rate is 1 for qualifying food drugs and medical appliances and 625 on general merchandise.

There are 43 states that collect state income taxes. If you would like to. Youll need to file Form IL-1040 at tax time.

Vehicle use tax bills RUT series tax forms must be paid by check. The tax rates on this. Up to 25 cash back This tax is based on a businesss net income.

Or you may print out your tax form and. Answers others found helpful. Youll report the income you earned.

The states personal income tax rate is 495 for the 2021 tax year.

Biuro Rachunkowe Katowice Kfk Expert Ustawa O Podatku Bankowym Sejm Przyjal Wiekszosc Poprawek Tax Day Piggy Bank Owe Taxes

Where S My Illinois State Tax Refund Taxact Blog

Tax Refund Deadline 2022 What Should You Know Before April 18 Marca

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Tax Refund 2021 Tips On How To Avoid Delays As Pandemic Continues To Impact Irs Abc7 Chicago

Illinois Needs Fair Tax Reform Afscme Council 31

Tax Refund 2021 Tips On How To Avoid Delays As Pandemic Continues To Impact Irs Abc7 Chicago

State Income Tax Rates Highest Lowest 2021 Changes

How To File Taxes For Free In 2022 Money

2022 Tax Day Filing For A Tax Extension Here S How That Works And When Your Taxes Are Due Nbc Chicago

Shortcut Road Markings Shortcut Country Roads

Mississippi State Capitol Capitol Building Mississippi State Mississippi Travel

Pin On Real Estate Is My Passion

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

10 Euros Offert En Bitcoin Sur Coinbase

The Best School Districts In Illinois In 2014 As Ranked By Schooldigger Http Www Disclosurenewsonline Com 2015 01 25 Th School Fun School District Illinois

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)